“With this price of 825 francs and the costs of production, we’re going to find it difficult to feed our families, to look after ourselves, and to invest in the farms,” Doumbia said via video call. “We accept the price because we have to.”

But she said higher prices also created headaches for cocoa producers, as chocolate makers allegedly resist paying higher market values.

In 2019, Ivory Coast and Ghanaian authorities introduced a Living Income Differential, which added $400 to the price of a ton of cocoa in a bid to protect farmers from poverty.

However, some chocolate companies reportedly tried to avoid complying with the LID. Mondelez International was accused by authorities of failing to pay the premium — an allegation it denied — while U.S. candy giant Hershey turned to futures exchanges to avoid paying the additional cost, Reuters reported. Hershey said in a statement at the time that it would not discuss details of its specific buying and hedging activities. The company told the news agency it bought cocoa “from a variety of suppliers and sources,” including some that saw it pay Ghana and the Ivory Coast’s LID premium.

“A year ago, when the price was 1000 francs, we were struggling to sell our cocoa because Big Chocolate thought it was too expensive,” Doumbia told CNBC. “So yes, it’s difficult to accept a lower price, but now we might actually be able to sell all of our cocoa.”

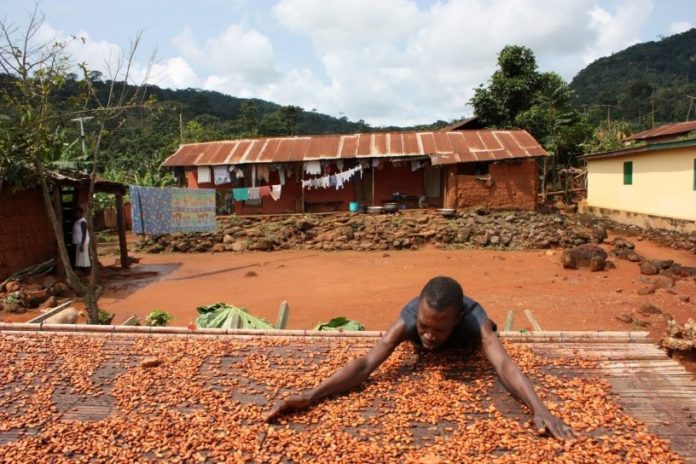

Doumbia said she has seen soil fertility decrease over the years, which she attributes in part to climate change, prompting her to dedicate four hectares of farmland to rubber instead of cocoa.

“Producing cocoa is a culture in Ivory Coast, we produce the most in the world so it’s not going to disappear overnight,” she told CNBC. “At least every family has a person that produces cocoa – it’s what we love to do, it’s our job, it’s in our hearts.”

But she added: “People are abandoning cocoa for rubber. With such painful work and such a low price for cocoa, you’re going to see that more and more for sure.”

According to a 2018 report on the industry from the VOICE Network — a global network of NGOs and Trade Unions — large chocolate companies increased their profits after the Ivory Coast’s cocoa prices dropped significantly in mid-2017.

Dutch chocolate maker Tony’s Chocolonely pays a premium on top of the farmgate price when it purchases its cocoa. It recently announced plans to increase that premium from $462 per metric ton – 26% above farmgate price – to $793 per metric ton – 54% above farmgate price – for the 2021/22 season.

Paul Schoenmakers, head of the impact at Tony’s Chocolonely, accused so-called Big Chocolate of “turning a blind eye” to the plight of African cocoa farmers “in quite a terrible way.”

“For decades, they’ve come up with all these fancy programs and the reality is that they haven’t yielded any results,” he told CNBC via telephone. “And that’s mainly because they still pay too little for cocoa.”

He added that paying the price suggested by Tony’s would cost around 0.7% of annual global chocolate revenues.

“Given that this sector is super-rich, they’d still make massive profits every year,” Schoenmakers said. “This is about shipping part of the value to the first part of the supply chain, the cocoa farmers, and it’s the right thing to do.”

According to Fairtrade, the average cocoa farming household in the Ivory Coast is made up of eight people and has an annual income of around $3,000. But Fairtrade’s research concluded the average cocoa farming household should be earning about $7,500 a year to cover their full cost of living.

“Price matters,” David Finlay, senior supply chain manager at The Fairtrade Foundation, told CNBC in a phone call. “We see this price drop as problematic, not just because we think it will lead to reduced incomes for cocoa farmers, but because we think those lower incomes will exacerbate other social and environmental problems, like deforestation.”

Chocolate giants weigh in.

Mars Wrigley, which makes M&Ms and Snickers bars, told CNBC in a statement that today’s supply chain was “not in line with our ambition that everyone — especially cocoa farmers — should have the opportunity to thrive.”

“Through our Cocoa for Generations strategy, ongoing support for the LID, and disclosure of our progress publicly, we remain focused on the critical issues that need to be addressed for cocoa farming families to thrive and be sustainable,” a spokesperson said via email.

Meanwhile, confectionery giant Ferrero said it had been working to improve the livelihoods of farmers in the Ivory Coast for years, adding that its objective was “to build value chains and work to maintain them.”

Cadbury maker Mondelez International told CNBC it was committed to boosting farmer incomes, noting that it had developed and invested $400 million in the sustainable cocoa sourcing program Cocoa Life.

A spokesperson for Nestlé told CNBC in an email that it began rolling out its cocoa sustainability program more than a decade ago. The company announced in September that it would implement new living income programs for farmers.

Meanwhile, Lindt & Sprüngli – which sources its West African cocoa beans from Ghana – told CNBC it had initiated a program in 2008 aimed at improving the quality of life for farmers.