The Ghana Agricultural Insurance Pool (GAIP) is concerned about the low patronage of farmers in agriculture insurance schemes, projecting that this reluctance could have unpleasant consequences for the sector’s value chain.

Being the only mandated insurance company in Ghana to underwrite agro-related insurance businesses on behalf of insurers in the Pool, GAIP’s aim is to protect farmers and other players in Ghana’s agricultural industry from the negative economic effects of climate change and perils associated with agriculture/agribusinesses.

The Pool, since its inception in 2011, has developed a sustainable portfolio of innovative insurance products as a solution to mitigate the financial risks associated with agribusinesses.

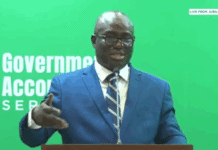

“Unfortunately, GAIP has registered only 30,000 farmers nationwide in 10 years since 2011, out of an estimated farmer-population of about 11.3 million in Ghana,” General Manager of GAIP, Alhaji Ali Muhammad Katu said.

Alhaji Katu attributed this low patronage to the general hesitation exhibited by people for subscribing to insurance policies, a phenomenon that cuts across all sectors.

He said though agriculture insurance was non-existent in Ghana before the advent of GAIP, the Pool has however achieved some gains and will build on them. “At least, for now, we have a record; only that the patronage of agriculture insurance is still low and we have to quickly double-up and increase the figures. It’s just like vehicle insurance – wherein the police ensure compulsion and compliance by drivers,” he said.

Factors inhibiting agric-insurance patronage.

Despite the pursuit of increasing insurance in the sector, GAIP also admitted that agriculture insurance is very expensive -and for that matter comes with high premium risks.

The Pool further said low patronage can also be ascribed to the lack of education for farmers to enable them to understand that insuring their businesses comes with several positives. “Apart from the aforementioned, the droughts, changing rainfall patterns, and diseases all make it expensive to insure the sector for banks and financial institutions,” Mr. Katu said.

Measures to increase agric insurance.

The GAIP, Mr. Katu said, is currently collaborating with some financial institutions to support financing for farmers. Through the collaboration, the GAIP has aligned with the Ghana Incentive-Based Risk-Sharing System for Agricultural Lending (GIRSAL) and partner banks to enhance financing to the sector through an agric-financing module.

The GIRSAL, according to the collaboration, is providing guarantees for the banks to enable agriculture lending – with GAIP complementing that by providing insurance for harvests. “So, for now, GAIP and GIRSAL’s collaboration is somehow addressing the issue of access to credit while we work to increase the number of farmers in the register,” Mr. Katu indicated.