Amid improved rainfall which has been better than the previous year, market watcher, Databank, anticipates that a better food harvest season could tame the rise in food inflation from the latter part of the third quarter to the fourth quarter.

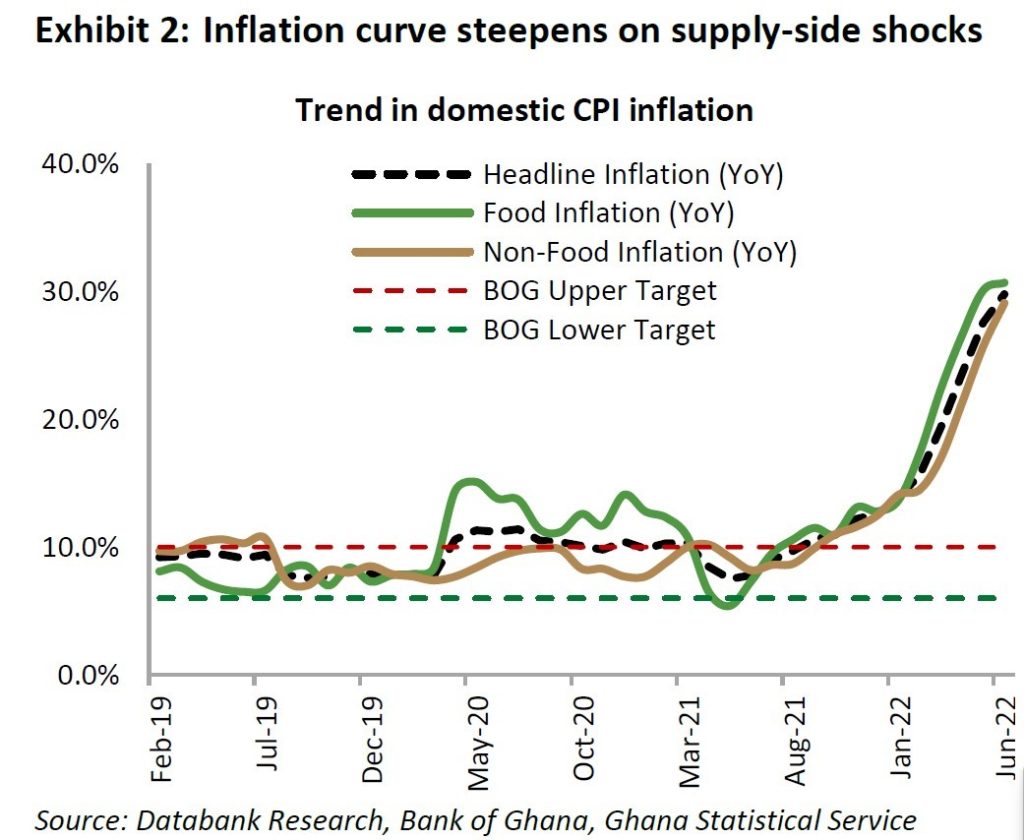

Although food inflation in June 2022 extended its gains by 60 basis points (bps) to 30.7 percent year on year (y/y) from 30.1 percent (y/y) in May 2022, its growth momentum moderated significantly compared to the 350 bps increase in the previous month. The slower growth in food inflation, according to the Ghana Statistical Service (GSS), was mainly driven by a deceleration in the inflation of ready-made food and vegetable sub-groups.

Food inflation’s contribution to total inflation has, however, declined further below the 51 percent level.

Databank noted that exclusive from the adverse effect of fertiliser shortage, there is much expectation for a better food harvest this year.

“This could tame the rise in food inflation with a downward pressure on headline inflation when combined with continued tightness in the monetary policy stance,” the asset management company said.

In addition to the global shocks to fertiliser costs and food supply chains, Databank observed that this year’s food inflation trend partly reflects the lagged impact of the disappointing harvest from last year.

“The poor rainfall pattern during the 2021 planting season undermined food harvest and led to an uptick in the September 2021 inflation against the historical trend of a decline in September inflation rates,” it stated.

Notwithstanding the Bank of Ghana’s tighter policy stance, inflation showed little signs of moderation as the cost-push factors evade the immediate reach of the monetary squeeze. Cumulatively, since March, BoG hiked the policy rate by 450bps to 19 percent in May 2022 in addition to the total withdrawal of COVID-related support for aggregate demand.

“While we observed a drastic reduction in GH¢ liquidity on the interbank market, its curb on price pressures has been subdued by the tremendous shocks to the cost of business operations and supply chains,” Databank said.

Available data from the Food and Agriculture Organisation of the United Nations show the global food price index declined in June 2022 by 2.3 percent to 154.2pts, marking the third successive month of decline although still 23.1 percent higher than a year ago.

This global easing is deemed favourable for domestic food CPI as Ghana approaches the third quarter of food harvest.

Nonetheless, consumer inflation is expected to remain elevated, closing the year at 25.3 percent ± 100bps due to the overwhelming cost pressures amid the external uncertainty.

Upside risk to inflation.

The external uncertainty, especially on energy, remains a key upside risk to inflation for the second half of the year.

Further to this, a hike in domestic utility tariffs is expected to fan the inflation flame. The request for hikes in electricity (+148 percent) and water (+334 percent) tariffs – although remains under consideration by the Public Utilities and Regulatory Commission (PURC) – is expected to be substantial enough to sustain the cost-push on consumer price inflation.