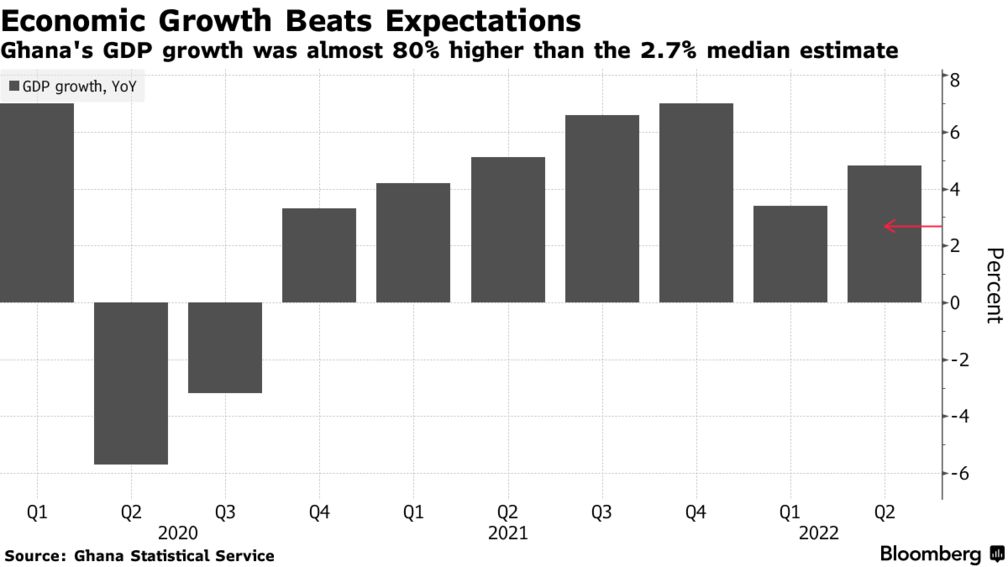

• GDP expanded 4.8% in the second quarter; the median estimate was 2.7%

• Ghana targets annual economic growth of 3.7% this year

Ghana’s economy grew faster than expected in the three months through June, expanding 4.8%, buoyed by manufacturing and cocoa production.

The median of five economists’ estimates in a Bloomberg survey was for a growth of 2.7%. Yields on Ghana’s dollar bonds were little changed after the release of the data, with the government’s budget targets seen as increasingly attainable. The economy grew 1.1% from the previous quarter.

Manufacturing was one of the main drivers of growth, along with cocoa production, Government Statistician Samuel Kobina Annim told reporters in the capital, Accra, on Tuesday. Ghana is the world’s second-biggest producer of chocolate-making ingredients after the Ivory Coast.

The industry sector accelerated to 4.4% from a year earlier, compared with a 0.5% contraction in the previous quarter, expansion in the agriculture sector slowed to 4.6% from revised growth of 5.1%, and services gained 5.2% from 5.6%.

The yield on Ghana’s dollar bonds maturing in 2032 widened by 5 basis points to 24.8% at 11.15 a.m. in Accra.

The pick-up in growth momentum will likely improve West Africa’s second-largest economy’s chances of reaching its expenditure and revenue targets. The finance ministry in July cut its growth forecast for 2022 to 3.7% from 5.8%. The median estimate of seven economists polled by Bloomberg last month is for an expansion of 3.9%.

Economic growth may be lackluster in the second half of the year due to weak private consumption, Mark Bohlund, a senior credit research analyst at REDD Intelligence said ahead of the release. Business conditions deteriorated for the seventh month and are at their worst level since the height of the pandemic as price pressures continued to weigh on demand, the S&P Global Ghana Purchasing Managers’ Index shows.

Inflation is at its highest level in 21 years, fanned by a 39% decline in the value of the cedi against the dollar. This prompted the central bank to raise the benchmark interest rate by 850 basis points in November, the steepest margin since the central bank was granted the independence to set borrowing costs in 2002, dampening consumer spending and deepening poverty.

Adverse economic conditions led the government to approach the International Monetary Fund in July for a $3 billion economic-support program. The lender is due to make a follow-up visit to Africa’s second-largest gold producer in the coming weeks.