The ongoing impasse between principal actors in the export logistics of horticultural products is threatening to keep the country uncompetitive in the multi-billion-dollar global horticulture market, rob the nation of desperately needed foreign exchange (FX) and undermine efforts aimed at self-sufficiency.

The stand-off stems from the decision by ports regulator, Ghana Ports and Harbours Authority (GPHA), to give the once-exclusive licence for two critical aspects of the sea freight process (stevedoring and shore handling) held by a company owned by the horticulture industry to a new company in which it owns a 25 percent stake – the Fruit Export Terminal Limited (FET).

This has left a vehicle expressly set up by government and the industry for this purpose – the Fruit Terminal Company Limited (FTC) – without any control of its logistics, contrary to industry practice in leading horticulture exporting countries such as Kenya, Cameroon, Cote d’Ivoire and South Africa; thus leading to lowered efficiency and higher cost.

More significantly, the industry risks losing the future opportunity/ability to further drive down costs by balancing costs of importing agricultural cargos to subsidise fruit exports, as is done in most other horticulture exporting countries.

This can only be done if the Fruit Terminal and all associated operations in the fruit port are in the hands of an entity like FTC – which is not a profit-making company but rather has a mission to reduce the cost of exporting for farmers.

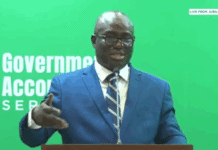

Commenting in an exclusive interview on the above impasse, Chief Executive Officer (CEO) of Ghana Incentive-Based Risk-Sharing System for Agriculture Lending (GIRSAL), Kwesi Korboe, stated that the development will leave the country struggling to compete in the market – even with fruit such as banana where it has a clear advantage over its continental peers in terms of production cost.

With logistics accounting for up to 80 percent of eventual cost of the product on retail shelves, he said: “If Ghana wants to compete, it is in the reduction of logistics cost. When the logistics are good, people will come to invest in the production of diverse agricultural products that will make the industry grow,” he said – citing banana, which has brought more than €600million into the country over the past 15 years and close to €54.93million in 2021 alone.

He further explained that as a result of the current cost and proposed logistics arrangements by GPHA, Tema becomes “the most expensive throughput for horticultural exports among major export countries in West Africa for like-to-like products”. A pallet at Tema is currently priced at US$25.5, compared to US$17 in Doula and US$14 in Abidjan.

Origin story

In line with government’s export drive policy, the Ministries of Food & Agriculture/Trade & Industries in collaboration with GPHA in 1996 allocated Shed 9 to the horticultural industry – to expedite and stimulate sea freight exports of horticultural products. The rationale was to enhance competitiveness of the domestic horticultural sub-sector through sea freight, and open up logistics to horticultural products that do well by sea freight for increased volumes of exports – which also drives product diversification.

In 2002, government through a World Bank-funded (Horticulture Export Industry Initiative) Programme, rehabilitated Shed 9 into a modern facility to improve horticultural product-handling and quality. The FTC was established in 2009 under the aegis of the Ministry of Food and Agriculture (MOFA) by a consortium of horticultural exporters represented by the Sea-Freight Pineapple Exporters of Ghana (SPEG).

From its inception, FTC was the sole entity exclusively responsible for stevedoring/shore-handling – the loading and/or unloading of cargo and horticultural products on dedicated horticultural vessels provided by the African Express Line (AEL) at Tema Port.

This was the arrangement until 2017 when GPHA arbitrarily granted exclusivity licence to FET – which is partly owned by a one-time service provider to FTC – and cancelled both the stevedoring and shore-handling licences of FTC.

Several attempts to renew the licence of FTC for both processes have so far proven futile; and after representation to government by the industry on the regulator GPHA’s posture following its action, the Economic Management Team (EMT) directed GPHA to grant the two licences to FTC. This has been done – half-heartedly – by GPHA instructing FTC to conduct the shore-handling while FET maintains stevedoring.

However, Mr. Korboe believes such an arrangement defeats the purpose as both entities have divergent objectives, which could end up worsening the situation. “That arrangement will not work as both parties have different objectives. The horticultural industry is trying to reduce the cost to boost sales by staying competitive with its competitors in Cote d’Ivoire and Cameroon, while the other party is seeking a higher return on its investment,” he explained in an exclusive interaction with the B&FT.

It cannot be proper that a horticultural production/export company wrestles with production-related issues only to find its logistics arrangements managed by an entity that hasn’t got any risk exposure in production. Describing the developments at Shed 9 as a test-case for consensus-building, he charged stakeholders to look to the commitment of successive governments to ensuring the horticultural export industry’s success. In his view, the final price for logistics services should be determined by exporters.

“This is a project that was conceived and has been implemented by different administrations, devoid of politics. At GIRSAL, we are in partnership with GEPA, the private sector and government agencies supporting an export diversification initiative focused on both indigenous and foreign-owned entities. We believe if this impasse is not sorted out will become a disincentive for further investments in the space,” he added