China is helping African countries to grow more food products and set up industries to process farm produce as part of efforts to reverse a long-time trade imbalance in its favour.

It is also increasing African food imports after more than two decades of mostly buying raw materials from the continent while exporting electronics and textiles, resulting in a trade surplus that saw China accused of promoting the unhealthy imbalance. Last year, Chinese exports to Africa made up nearly 60 per cent of the US$282 billion in two-way trade.

But new initiatives to support African agriculture, industrialisation and skills development did not mean a shift away from infrastructure building, long a mainstay of China’s engagement in Africa, observers said.

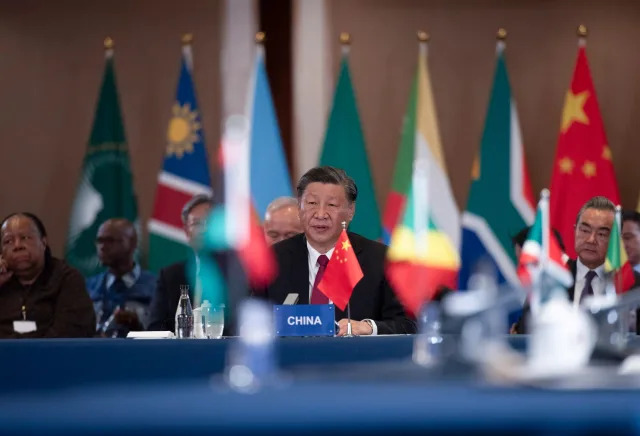

Chinese President Xi Jinping recently unveiled plans to build more manufacturing plants in Africa, ramp up food production there and equip thousands of Africans with vocational skills to support the continent’s agricultural modernisation.

“China will harness its resources … to support Africa in growing its manufacturing sector and realising industrialisation and economic diversification,” Xi said in late August on the sidelines of the Brics summit in Johannesburg, South Africa.

He also pledged closer cooperation on quarantine and inspection to help boost Chinese imports of African farm produce.

The comments were a continuation of a pledge made by Xi during the 2021 Forum on China-Africa Cooperation (FOCAC), when he promised to open up “green lanes” for African agricultural products so that imports could hit US$300 billion by 2024.

To that end, Beijing waived tariffs last year on 98 per cent of taxable items from dozens of least-developed countries, most of them in Africa.

In Johannesburg, Xi further promised support for developing Africa’s manufacturing industry and creating “Made in Africa” brands, and reiterated his 2021 promise to invest at least US$10 billion in the continent and extend US$10 billion in credit facilities for small and medium-sized enterprises.

Days later, the African Export-Import Bank announced it had secured a US$400 million loan facility from China Development Bank for onward lending to SMEs across Africa.

Xi’s pledges in Johannesburg – made during a meeting with African leaders and ministers on August 24 – came shortly after Beijing’s top diplomat in Africa, Wu Peng, said countries there wanted China to shift its focus from building infrastructure to local industrialisation.

Xi’s comments also appeared to reflect a shift from the past decade, when China pumped billions of dollars into Africa through its Belt and Road Initiative, building mega projects such as ports, railways, highways and power dams.

However, analysts said the latest pledges did not indicate a turning away from infrastructure, but rather the opening up of parallel investment tracks.

“It is about fostering the next phase of using that infrastructure for new export markets and for rural income growth,” Lauren Johnston, a China-Africa researcher at the South African Institute of International Affairs in Johannesburg, said.

She said China’s own development model focused heavily on raising rural incomes since rural areas were mostly home to the poorest of the poor.

“So, raising rural incomes helps to alleviate poverty, which then feeds China’s global poverty alleviation ambition and helps to realise the [United Nations-led] Sustainable Development Goals too,” Johnston said.

Given its own rising population, Africa would need even more food over the next decades, Johnston said. Food security mattered more to China as well, she added, because the US-led trade war meant it was no longer confident about relying on the United States and Australia for feed and food.

Richard Mulwa, deputy vice-chancellor of Kenya’s Egerton University, said Xi’s plan would bring vitality to Africa’s food systems through joint research, technology transfer and the development of high-yield crops.

“The whole plan is good. For long, Africa has lagged behind in innovation, but with cooperation with China in research and development … [and] on agro-ecological parks, there are so many benefits to be realised,” Mulwa told Chinese state news agency Xinhua in a recent interview.

Linda Calabrese, research fellow and development economist at the Overseas Development Institute think tank in London, said: “We know that official policy lending [for the belt and road] is slowing down, but we also know that there may be some commercial lending or equity investment in infrastructure. So the focus on infrastructure may become more modest.”

“Given the nature of the projects, they may be undertaken by various line ministries, or by China’s development agency. In that case, they will not tap into the same sources of finance as infrastructure projects, and therefore they will not be competing, just be placed on a parallel track,” Calabrese said.

Carlos Lopes, professor at the University of Cape Town’s Nelson Mandela School of Public Governance, said Xi was trying to be responsive to the areas identified by Africa as a priority for engagement with China.

“There is a perception that the Belt and Road Initiative is running out of steam and requires a more robust wave of investments if China is going to keep its edge in Africa,” Lopes said.

In a commentary for The Conversation published in August, Johnston said there had been a shift in China’s relationship with Africa – away from a focus on mainly oil and extractive commodities. This was the “Hunan model”, named after the central Chinese province leading the push.

Johnston highlighted the Hunan model’s specific focus on agriculture, heavy industry equipment, and transport – such as electric vehicles and trains – areas where the province is a leader within China and which are growth industries in many African countries.

“Many of these [Chinese] companies have a presence in, and long-running strategy for, African markets,” she wrote.

This comes as China expands its list of food imports from Africa, with dozens of countries recently signing deals allowing the export of farm produce such as chillies, cashews, sesame seeds and spices.

South Africa, China’s largest trading partner in the continent, had long exported mostly minerals to the Asian country. Last month, it began sending avocados to China – joining Kenya and Tanzania whose fresh avocados gained market access last year and also adding to its existing export list of lemons, grapefruit, oranges and other citruses.

Beninese pineapples, Rwandan chilli and beef products from Namibia and Botswana have also gained China market access in recent months.

Peng, director general of the Department of African Affairs in the Chinese foreign ministry, confirmed last month that the first 52-tonne shipment of Kenyan anchovy had arrived in China.

“More is on the way,” Wu said. [The FOCAC] green channel for African agricultural exports to China is bringing tangible benefits to African and Chinese people.”